“I’m very bullish on technology, especially with the labor shortage. …Who’s going to replace all these employees we can’t find? It’s going to be technology. Who’s going to replace all the meetings that we don’t go to anymore in person? It’s going to be technology. I think the world has changed so dramatically that we don’t want to accept (it). Boards are never going to operate the way they used to operate. Employees are never going to have to go back to work in the office five days a week.

We’ve never had more information at our fingertips about daily health. We can track our steps. We can track our heart rate, our blood sugar, our blood pressure and more vitals in real-time through the day. This unprecedented level of understanding about our daily activity levels is leading to a boom in the connected health industry.

Corporate concentration is hitting levels we haven’t seen in decades. … As many industries digitized themselves, the competitive dynamics are increasingly ‘winner take all.’ They just keep getting bigger. … Larger companies were able to have more financial flexibility as the pandemic hit, and then in 2021 as supply chains became constrained, larger companies were also better able to manage the inventory and cost pressures.”

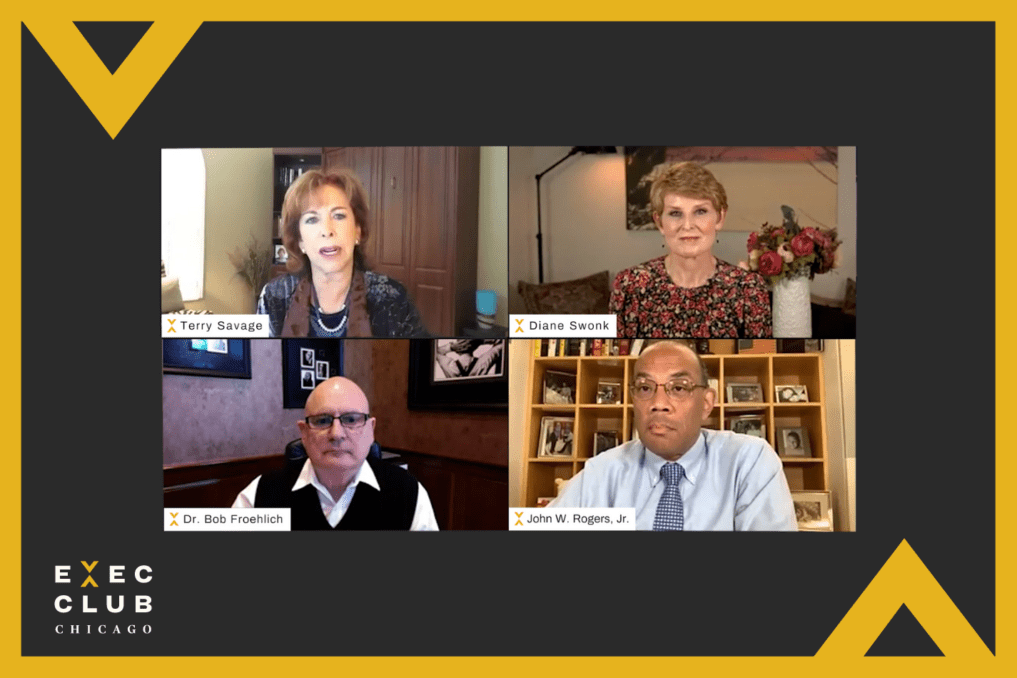

—Dr. Bob Froehlich, Owner, Kane County Cougars Baseball Club; Former Vice Chairman, Deutsche Asset Management